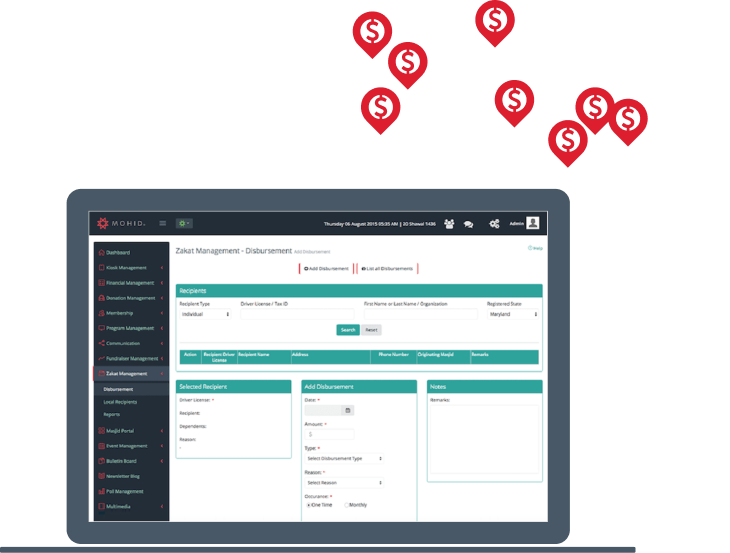

Purpose and Benefits of Zakat Management in MOHID

The process of developing and reinforcing zakat management through MOHID Cloud has several purposes and benefits, as follows

- Improving the community’s trust and growing social capital toward the information media of MOHID as a tool and zakat management facility, and toward regarding the security and safety of zakat management

- Increase the optimal services to provide convenience that meets the needs of the community, through improving both self-service and full-service

- Encouraging progress and innovation in digital-technology-based zakat management by delivering

easy access and improving the quality of optimal products and services - Improving competitiveness among technology-based zakat management

- Maximising the transparency and accountability

- Improving literacy and education on zakat through authorities

Fundraising ideas for mosques

As one of the pillars of Islam, zakat is a form of obligatory donation that has the potential to ease the suffering of millions. With the literal meaning of the word being 'to cleanse,' Muslims believe that paying zakat

- Purifies

- increases

- blesses the remainder of their wealth.

The technical definition of Zakat is a charitable donation made by Muslims, calculates as 2.5% of their surplus wealth. In simple terms, Zakat is calculated as 2.5% percent of your savings and financial assets that are not used towards your living expenses.

The Holy Quran has mentioned Zakat more than eighty times. It is a duty from Allah similar to the duty of ‘Salat’.

Allah commands in the Holy Quran.

فَأَقِیمُوا الصَّلَاةَ وَآتُوا الزَّكَاةَ وَاعْتَصِمُوا بِاللَّـھِ

“So establish Salat and give Zakat, and hold fast to Allah”

Zakat is one of the five pillars of Islam. The Prophet Muhammad (SAW) said:

“Islam was built upon five pillars: to witness that there is no God but Allah and that Muhammad (SAW) is His servant and messenger , performing prayer , giving Zakat, performing pilgrimage and fasting the month of Ramadhan”

The First caliph Hazrat Abu Bakar Siddique (RA) declared war on the tribes who refused to pay Zakat, though, they were still observing Salat and professing Islam in other matters. He reasoned that Divine Law (Shariah) cannot be divided and that one cannot follow part of the Holy Book and cast aside other parts.

The Holy Quran has mentioned in detail the people who are eligible to receive Zakat. The Quran says:

إِنَّمَا الصَّدَقَاتُ لِلْفُقَرَاءِ وَالْمَسَاكِینِ وَالْعَامِلِینَ عَلَیْھَا وَالْمُؤَلَّفَةِ قُلُوبُھُمْ وَفِي الرِّقَابِ وَالْغَارِمِینَ وَفِي سَبِیلِ اللَّھِ وَابْنِ السَّبِیلِ فَرِیضَةً مِنَ اللَّھِ وَاللَّھُ عَلِیمٌ حَكِیمٌ

“The Sadaqat (Alms) are only for the poor, the needy, those who collect them, those whose hearts are to be reconciled, to free the captives and the debtors for the cause of Allah and for the travellers, a duty imposed by Allah, Allah is full of knowledge & wisdom.”

Who can't we give Zakat to?

Muslim jurists agreed that Zakat cannot be given to the following people:

- The rich (except when such are among the workers of Zakat or the wayfarer).

- Those capable but not willing to work.

- Non-Muslims and those who fight against Islam.

- Ascendants, descendants and wives of the payer.

- The family of the Prophet (peace be upon him).

Types of Zakat system:

There are two types of Zakat:

- Zakat ul Mal

- Zakat ul Fitr

The first difference between Zakat and Zakat ul Fitr is eligibility. All Muslims, who have enough food for a day, must pay Zakat ul Fitr (otherwise known as Fitrana) regardless of their age or financial status.

However, Zakat is pay only if a Muslim has the Nisab level.

The nisab threshold is the minimum amount of wealth a Muslim must have before he or she becomes eligible to pay Zakat.

The second difference lies in the amount due. The amount attributed to Zakat al Fitr is very small - with Penny Appeal, it costs just £3.50, the cost of a nutritious meal. It is the same amount for all, regardless of financial situation.

Zakat, however, depends on your personal wealth, because it comprises 2.5% of all net savings, so it varies greatly from person to person.

The third difference lies in their due dates, so that Zakat can pay at any time, with the only condition being that the earnings reflect one year’s worth of net savings (one lunar year).

Zakat ul Fitr, or Fitrana, however, is pay during Ramadan before the month ends. It needs to pay before the Eid prayers at the very latest. This is a very specific time frame that all Muslims must abide by.